Let’s say you need a common generic drug - maybe lisinopril for high blood pressure or metformin for diabetes. You check your insurance copay: $15. Then you look up the same pill on Amazon Pharmacy or Mark Cuban Cost Plus Drug Company. It’s $8. You think, Why am I even using insurance? But then you try to order a less common drug - say, a generic version of a neurological medication - and it’s not available anywhere online. You’re stuck. That’s the reality of direct-to-consumer (DTC) pharmacies in 2026: sometimes they save you serious money, sometimes they don’t work at all, and figuring out which is which takes serious time.

What exactly are DTC pharmacies?

DTC pharmacies are online drug sellers that skip insurance companies and pharmacy benefit managers (PBMs) entirely. Instead of letting your insurer negotiate prices behind closed doors, they sell directly to you for cash. Think of them like a wholesale club for pills. You pay the price listed, no form, no prior authorization, no copay tiers. The big players are Amazon Pharmacy, Mark Cuban Cost Plus Drug Company, Costco, Walmart, and Health Warehouse. These aren’t shady sites - they’re backed by major retailers or well-known figures. Mark Cuban’s company, for example, openly states it charges cost plus 15% - no rebates, no hidden fees.

But here’s the catch: not every drug is available. A 2024 study in the Journal of General Internal Medicine looked at 100 of the most common and expensive generic drugs. One-fifth of the most costly generics - the ones people need most - simply weren’t stocked by any national DTC pharmacy. If you’re on one of those, you’re out of luck. No amount of price shopping will help.

How much can you actually save?

The savings aren’t the same for everyone. It depends on what you’re taking.

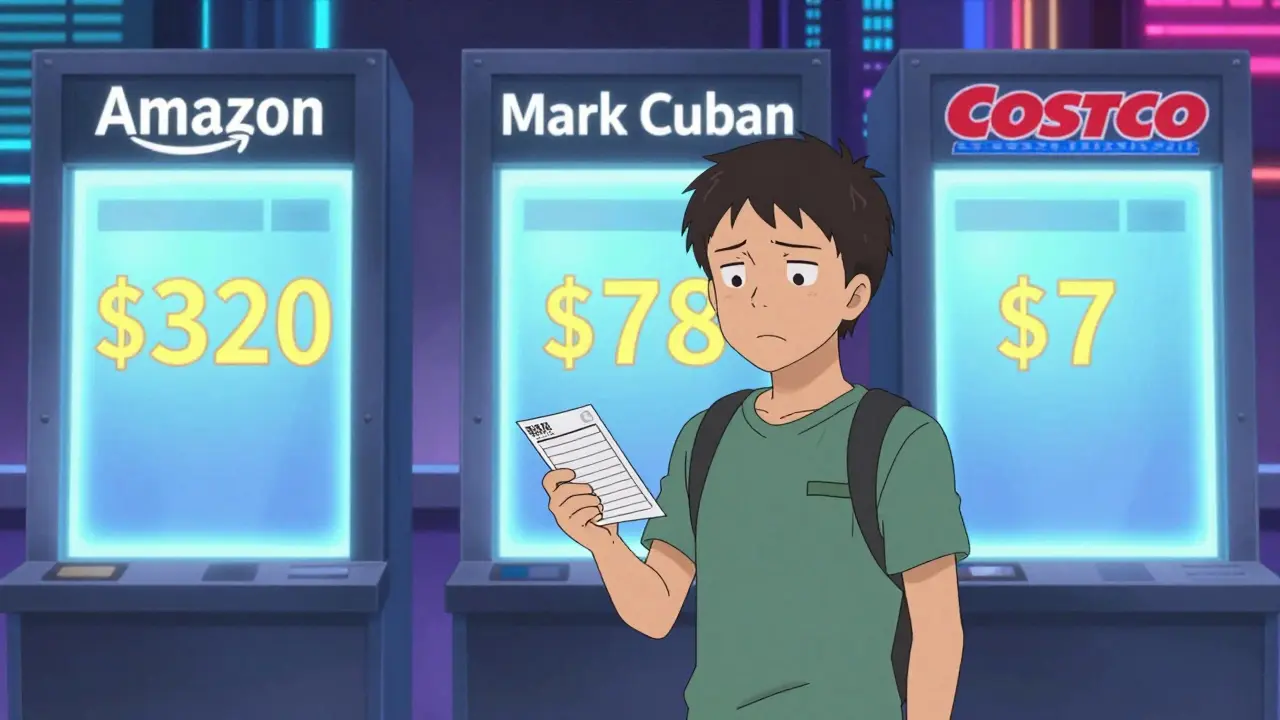

For expensive generics - the drugs that cost over $100 a month under traditional pharmacy pricing - DTC pharmacies shine. The same 2024 study found that, on average, people saved $231 per prescription by buying these drugs outright online instead of paying retail prices. That’s a 76% drop. For example, a 30-day supply of a high-cost generic like naltrexone for alcohol dependence might cost $320 at a regular pharmacy. On Amazon, it’s $89. On Mark Cuban’s site, it’s $78. That’s not a typo. That’s life-changing money for someone paying out of pocket.

But for common generics - the everyday drugs like atorvastatin, metformin, or levothyroxine - the savings are much smaller. The median savings? Just $19. That’s about 75% off retail, sure, but if your insurance copay is already $5 or $10, you’re not saving much. In fact, for these drugs, Costco often beats DTC pharmacies. Their cash price for a 30-day supply of many common generics is under $10. Sometimes under $5. You don’t even need a membership to use their online pharmacy.

Who wins? Amazon, Mark Cuban, or Costco?

It’s not one-size-fits-all. The 2024 study broke it down by drug type:

- For expensive generics: Amazon had the lowest price on 47% of them. Mark Cuban came second at 26%. Costco was way down at 13%.

- For common generics: Costco won with the lowest price on 31%. Amazon was close at 27%. Walmart was third at 20%. Mark Cuban? Only 10%.

That means if you’re on a high-cost drug, Amazon or Mark Cuban are your best bets. But if you’re on routine meds like blood pressure or cholesterol pills, Costco is often the cheapest - even cheaper than most DTC options. And you don’t have to be a member to buy from them online.

Walmart’s online pharmacy also offers some of the lowest cash prices on common generics - often under $10. But they don’t carry as many expensive ones. So if you’re trying to save on both, you need to check all three.

Why insurance sometimes beats DTC

Here’s the twist: if you have insurance, DTC pharmacies might not save you anything - or could even cost you more. A 2023 study from CVS Health, looking at 79 neurological generics, found something shocking: if everyone switched to DTC pharmacies, out-of-pocket costs would go up by $82 million. Why? Because many of these drugs - the ones people with epilepsy, Parkinson’s, or migraines rely on - aren’t available on DTC sites. Mark Cuban’s pharmacy carried only 33 of the 79. And of those 33, only two were cheaper than what insured patients paid out of pocket.

That’s because insurance companies negotiate bulk deals. Even if your copay is $15, your insurer is paying $30 behind the scenes. The pharmacy gets paid, you get your meds, and you’re not shopping around. DTC pharmacies don’t have those deals. So if your drug is available and cheaper online, great. But if it’s not, or if your insurance already gives you a rock-bottom price, switching could cost you more.

The hidden cost: time

There’s another price tag nobody talks about: time. To find the best deal, you can’t just check one site. You have to compare at least four: Amazon, Mark Cuban, Costco, and Walmart. For each drug. Every time you refill. If you take five different medications, that’s 20 price checks per month. And that’s assuming all your drugs are available. If one isn’t, you have to go to your local pharmacy anyway.

There’s no tool that tells you, across all platforms, which pharmacy has the lowest price for your exact prescription right now. The 2024 researchers said it plainly: “There are no simple, accurate, and comprehensive tools” to do this. You’re left doing manual labor - clicking, comparing, copying, pasting. For people with chronic conditions, that’s not just annoying. It’s exhausting.

Who benefits the most?

DTC pharmacies aren’t a magic fix. They’re a tool - and they work best for specific people:

- Uninsured or underinsured: If you’re paying full retail, DTC pharmacies can slash your bill by hundreds of dollars on expensive drugs.

- People on high-deductible plans: If you haven’t met your deductible, paying cash online might be cheaper than your copay.

- Those taking high-cost generics: The bigger the price tag, the bigger the savings. Drugs like naltrexone, riluzole, or certain antivirals? DTC can save you 70-90%.

But if you’re on Medicare Part D with good coverage, or if your insurer already gives you $5 copays on common generics, you’re probably better off sticking with your current pharmacy. Costco’s cash prices are already so low that even DTC sites rarely beat them.

What should you do?

Here’s how to actually save money - without wasting hours:

- Start with your insurance. Check your copay. If it’s under $10, don’t bother with DTC for common drugs.

- Check Costco first. For most generics, it’s the cheapest option. No membership needed online.

- For expensive drugs, compare Amazon and Mark Cuban. Use their price calculators. Enter your exact drug, dose, and quantity.

- Don’t assume DTC works. If you can’t find your drug, go back to your pharmacy. It might be cheaper than you think.

- Use GoodRx as a baseline. It doesn’t sell drugs, but it shows you retail prices. If DTC is cheaper than GoodRx, it’s probably a good deal.

And if you’re on multiple drugs? Write them down. Track prices for one month. See where the real savings are. You might find that half your meds are cheaper with insurance, and the other half are better online. That’s normal.

There’s no single winner here. DTC pharmacies aren’t replacing insurance. They’re giving you another option - one that works brilliantly for some, barely helps others, and leaves many out in the cold.

Are DTC pharmacies safe to use?

Yes, the major DTC pharmacies - Amazon, Mark Cuban Cost Plus Drug Company, Costco, Walmart, and Health Warehouse - are licensed, regulated, and use U.S.-based pharmacies. They don’t sell counterfeit drugs. Always verify the pharmacy’s license by checking the National Association of Boards of Pharmacy’s Verified Internet Pharmacy Practice Sites (VIPPS) directory. If it’s not on there, walk away.

Can I use DTC pharmacies if I have Medicare?

Yes, but be careful. Medicare Part D already covers most generics at low prices. For common drugs, your copay might be lower than the DTC cash price. For expensive drugs not covered well by your plan, DTC can save you hundreds. Always compare your Part D plan’s price with DTC prices before switching. Don’t assume DTC is always cheaper - Medicare’s negotiated rates are often very good.

Why don’t DTC pharmacies carry all medications?

It’s a business decision. Many expensive generics are low-volume drugs - meaning few people take them. DTC pharmacies focus on high-demand, high-savings drugs to keep their model profitable. They don’t stock drugs that are hard to source, have low demand, or require special handling. That’s why neurological, psychiatric, and rare condition drugs are often missing. If your drug isn’t listed, it’s not because they’re hiding it - they just don’t carry it.

Is Mark Cuban Cost Plus Drug Company really cheaper?

For expensive generics, yes - often. Mark Cuban’s site has the second-lowest prices overall in the 2024 study, behind Amazon. But for common generics, Costco and Walmart beat it. Mark Cuban’s strength is transparency: he charges cost plus 15%, no rebates. But that doesn’t mean he’s cheapest on everything. Always compare.

Should I cancel my insurance to use DTC pharmacies?

No. Insurance covers more than just drugs. It protects you from surprise costs for hospital visits, emergency care, and specialty treatments. DTC pharmacies only help with prescriptions - and even then, not always. Canceling insurance to save on pills is like selling your car to save on gas. You might save a little now, but you’re risking everything later.

Comments (10)